The Canadian Immigration Department Has Revised The Maple Leaf Card Renewal Regulations: A Tax Receipt Is Required As Proof Of Residence. How Should Applicants Respond?

The Canadian Immigration Department Has Revised The Maple Leaf Card Renewal Regulations: A Tax Receipt Is Required As Proof Of Residence. How Should Applicants Respond?

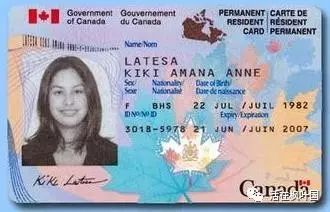

China News Service, July 10 (Xinhua) According to Canada's "World Journal" report, the Canadian Immigration Department recently revised its regulations and requires those who are renewing their Maple Leaf Cards to attach tax receipts from any two years in the last five years as proof of residence.

China News Agency announced on July 10 that according to a report by Canada's "World Journal", the Canadian Immigration Department has recently changed its regulations, requiring those who renew their Maple Leaf Cards to attach tax receipts for any two years in the last five years as proof of residence. However, many permanent residents who apply to become “non for tax” and live overseas with their citizen spouses are worried about having their Maple Leaf Cards returned when they renew their Maple Leaf Cards because they have not filed taxes. In response to the inquiry, the Immigration Department stated that a written explanation should be provided and would still be accepted.

Starting from April 30, the Canadian Immigration Department will change the permanent resident card, usually called the Maple Leaf Card, to be delivered by mail to designated locations. Applicants do not have to go to the Immigration Department office to collect it in person. This is a great boon for those who apply for renewal. However, starting from June, the Immigration Department revised the Maple Leaf Card renewal regulations, requiring applicants to pay a tax bill as proof of residence.

According to the application instructions recently released by the Immigration Department, the copies of documents that must be attached when applying for a Maple Leaf Card renewal include:

1. Old cards.

2. Passport or travel document.

3. Two types of identification documents, such as immigration papers, driver's license, student ID card, etc.

4. Other documents used to prove residence, including copies of all the inside pages of the passport, and personal income tax slips (Tax) for any two years approved by the tax bureau within the past five years.

The Department of Immigration specifically emphasizes on its website that those with incomplete documents will have their application documents returned. For most applicants, as long as they have actually lived in the country for more than two years in the past five years, it is not a big problem to prepare these documents; however, applicants who have become "non-tax residents" do not need to file taxes in Canada and naturally cannot obtain a tax bill issued by the tax bureau, so they are worried that the application documents will be returned.

According to regulations, permanent residents must live in the country for two years within five years before they can continue to renew their Maple Leaf Cards. However, if they are accompanied by a citizen spouse living overseas, they are not subject to this restriction. Therefore, there are many "astronaut" families. After their spouses obtain status, they return to their original place of residence and live with their significant other who still holds a Maple Leaf Card to ensure that their immigration status will not be lost.

Huang Huizhen, the person in charge of Sophia Immigration Office, said that in the past few years, many Chinese immigrants who have returned to China have applied for "non-tax residents" before leaving the country due to tax considerations. Now, the Immigration Department has suddenly proposed that people who are renewing their Maple Leaf Cards submit two-year tax returns, which may have an impact on non-tax residents who have settled overseas.

Lisa-Marie Gagne, the spokesperson for Western Canada, said in response to the "World Journal" inquiry that when non-tax residents apply for a Maple Leaf Card renewal, if they cannot provide the required proof of residence documents such as tax forms, they should explain it in writing when sending the documents. The Immigration Department will still accept it and will not return it. (Ruan Yaoyi).