Detailed Explanation Of Canadian Immigration Prison For 5 Years And 2 Years Of Living In Canada: How To Calculate The Residence Time To Avoid Renewal Issues

Detailed Explanation Of Canadian Immigration Prison For 5 Years And 2 Years Of Living In Canada: How To Calculate The Residence Time To Avoid Renewal Issues

One of the conditions for updating the Canadian Maple Leaf Card is to live for two years in five years, but many friends are skeptical about calculating the stay time, so today I will explain this in detail.Generally speaking, it is generally believed that Canadian immigration prisons can maintain their permanent residence status for five or two years. But I don

One of the conditions for updating the Canadian Maple Leaf Card is to live for two years in five years, but many friends are skeptical about calculating the stay time, so today I will explain this in detail.

Generally speaking, it is generally believed that Canadian immigration prisons can maintain their permanent residence status for five or two years. But I don't know how to live in these two years. Actually, I have good knowledge. At least, I will slow down my renewal and, worst of all, I will lose my hard-earned permanent residence status!

Next, the editor will tell you the real requirements of immigration prisons through two cases.

Case 1:

The applicant officially obtained permanent residence status in July 2013, and the expiration date of the maple leaf card is December 2018.

During the period of living in Canada, the following are:

July 2013 to December 2013 January 2017 to December 2017 April 2018 to December 2018 (stay 730 days)

The applicant submitted an application for a new leaf card in February 2019, but the application was rejected on the grounds that there was insufficient stay time! Fortunately, I did not directly refuse the visa, but I had to continue living until the number of days I met before applying.

However, there was no valid maple leaf card during this period, I was unable to enter and exit Canada freely, and when I returned to China, everything I had to do was delayed.

Therefore, the problem is that the applicant has been resided for 730 days in the 5 years he has obtained permanent residence. Why did the Immigration Bureau say he has not lived in it for 730 days?

Please note: One of the calculation methods for the past 5 years is to have 5 years from the renewal application and have 2 years of residence.

Since the applicant applied in February 2019, the opposite five-year period is: from February 2014 to February 2019, so his stay in 2013 cannot be calculated, which means that the applicant has not met the residence conditions yet!

Case 2:

The applicant obtained permanent residency status in 2010 and resided in 2010 2011. He successfully changed the card to the first time, but he has never lived since. It was not until 2019 that I logged into Canada again that I was denied entry by customs and my permanent residence was cancelled. In this case, it is basically no possibility of a successful appeal!

In other words, whether it is the custom of entering or the applicant himself submits a renewal, it can be used as the deadline for time. From this time period, it should be eligible for a 2-year residence, otherwise it may be at risk of being unable to renew or even losing its identity.

Therefore, Canadian immigration status is precious and difficult. For your own identity, please make a renewal plan in advance and avoid risks.

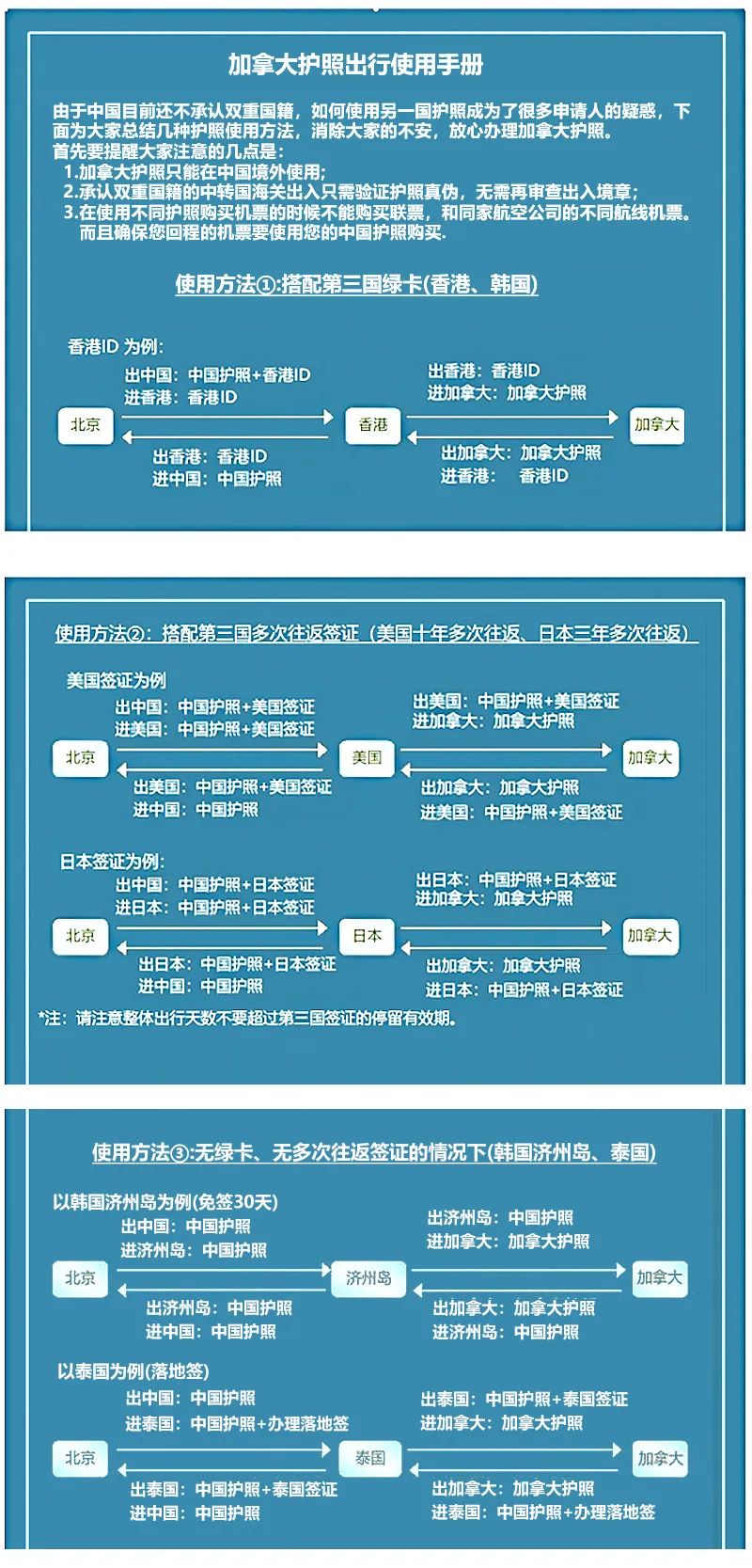

Of course, if you don’t want to be subject to various restrictions due to immigration prisons, you can also apply for naturalization. Once you have a Canadian passport, you will no longer worry about updating your maple leaf card.

In terms of social benefits that immigrants can enjoy, Canada's welfare is relatively more complete.

As long as you are a Canadian citizen, or a permanent resident of Canada or a holder of a maple leaf card, you can enjoy Canadian benefits in every way.

The most attractive thing for a long time is Canada’s greatest social welfare as an immigrant country.

Part 1, Various Insurance:

1. Medical insurance. Every province in Canada has a health insurance plan that provides low-cost and high-quality health care. Insurance plans include various medical services, medical expenses, hospitalization and surgery costs, but do not include medical expenses.

If a family doctor thinks you need hospitalization or even surgery, all costs are all costs of the Medicare plan regardless of the size of the surgery.

During hospitalization, the patient does not have to pay for food, medication, etc. themselves. Most prescription drugs are provided free of charge for older people over the age of 65, as well as those receiving social relief.

2. Employment insurance. Canadian residents (referring to Canadian permanent residents and citizens) continue to work for half a year. If they are unable to continue working due to unemployment, illness, childbirth or raising children, they can earn temporary income through Canada's National Employment Insurance Program, which means they will receive regular subsidies for a certain period of time to reduce the impact of unemployment.

The amount of subsidy an applicant receives depends on his/her working hours, his/her payment amount, and local unemployment rate. To apply for a subsidy, you must go to the Canadian Government Employment Center (), the institution that applies for a social insurance card ().

The second part is various welfare funds, subsidies, etc.:

1. The Social Welfare Fund of Canada Social Welfare Fund is used to ensure the basic living standards of every Canadian resident. If a Canadian resident has no income and deposits less than $1,000 in bank deposits, you can apply for this benefit. If a person can get $500-700 per month in Canadian dollars, a family of three can get $1,100-1,300 per month in Canadian dollars, which is enough to maintain a low-level lifespan.

New immigrants usually cannot enjoy this benefit within the first six months of logging into Canada, so a sum of funds is required after logging into Canada, which can last for six months.

2. Pension, Canada's legal retirement age is 65 years old. Canadian residents, regardless of their assets or income, are eligible for the Seniors program as long as they have settled in Canada for more than ten years.

Since 2018, eligible seniors will receive notification letters informing them that they have automatically joined the Older (OAS) and Older Income Guarantee Grant (GIS). Once the elderly who meet the conditions are over 65 years old and do not need to apply, he will automatically receive the money from the government. My first money was one month after my 65th birthday.

In fact, pensions are similar to domestic minimum living safety fund. The amount of pension is determined by the length of time the applicant lives in Canada and is paid monthly by the federal government.

3. Milk gold. In Canada, every child can receive monthly milk bonus subsidies from birth to 18 years of age, depending on the income of their parents last year. The purpose of establishing this subsidy is to help families with low incomes and to encourage everyone to have more children.

4. Guaranteed income auxiliary fund. If you receive a pension that does not have a small amount of income or no other income, you can also apply for additional auxiliary funds. This is called a guaranteed income auxiliary fund.

5. Government welfare aid, a short-term nature, provides assistance to those in need.

6. Family Assistance Fund. People over 65 years of age do not meet the payment requirements for elderly people, or single, widowed or divorced women between the ages of 60 and 64 years old, can apply for this long-term assistance fund.

7. Auxiliary funds. Seniors who receive assistance from the federal government but have no other income can automatically dispatch ancillary funds from the provincial government without applying separately.

Part 3, Retirement-related plans:

1. Canadian retirement plan. All Canadian provinces except Quebec have implemented Canadian retirement plans. The Canadian retirement plan is a public insurance plan. Canadian residents deduct a certain amount of pension contributions from their monthly income and receive subsidies through this program after retirement or long-term physical disability.

Pensions must be paid taxes and can be obtained by applicants wherever they are in the world. Quebec has its own plan called the "Quebec Retirement Plan".

2. Disable pensions. People who are disabled due to pensions during their work can apply for a disability pension.

3. Widow pension. The spouse and children of pension contributors can apply for widowed pensions after their donations die.

Part 4, Others:

1. Tax refund plan. Canada has developed two tax refund plans that can help low-income people with small incomes. They mainly include real estate tax refunds and shopping tax refunds. Even if you don’t have taxable income, you must fill out your income tax form to be eligible for a tax refund. If an elderly person receives a pension, he or she will automatically receive the application form.

2. Daytime parenting. If both parents have jobs, they may need to find a parenting center or private home parenting service to take care of their children. If parents cannot pay the full daycare fee, they may be eligible to apply for aid daycare fees (daycare allowance).

3. Incentive plan for first-time home buyers. The first-time homebuyer incentive program released in Canada can relieve the pressure on many new immigrants to buy a home. The government provides 5% (old house) or 10% (new house) loans to families who buy a house for the first time. The loan can be paid off within 25 years of purchase or when the home is sold based on the rise and fall of the home.

4. Maternity leave/parent leave. New immigrants should not forget that having babies in Canada is also beneficial. Mothers can take up to 15 weeks of leave and receive weekly subsidies.

Parental leave is a benefit for both parents, and there are 2 options - A. The parents can spend a total of 40 weeks, one of which will not exceed 35 weeks, and the corresponding subsidies can be obtained; B. The parents can spend a total of 69 weeks, and one of which will not exceed 61 weeks. Of course, the subsidies received will be reduced accordingly.

Canada's social welfare system dates back to the 1920s, so after years of improvement and development, it was basically improved and maintained until the 1980s. Now it can be called a very complete welfare society.